This mostly of those fears about Omicron within five, six days are easing. Another 400 points, as of right now, as I’m looking. Yesterday, the Dow surges 600 points, nice rebound. It’s here.” And they use Omicron as an excuse, which is fine, but that spooked the markets and the markets fell sharply. And then, maybe then start raising rates.” But he said, “Nope, it’s no longer transitory. They just didn’t know that.įrank Curzio: But what was the surprise in the market is, yeah, we saw inflation rise, but we just didn’t… We all thought, “Hey, they’re going to say it’s transitory for another year or two. Right? We all knew that, right? This, my daughter knew that. These people had no idea that inflation was not going to be transitory. I have no idea how the smartest guys in the world that make a fortune, that do very, very well, and they’re in Fed. The smartest guys in don’t know, because I don’t know if they get their stuff served to them, they don’t have to pay for that shit. Everybody knew this inflation, except for the Fed. It’s going to happen sooner, probably next year, mid-next year.” That was a big surprise. Says, “We’re going to need to raise rates as inflation’s no longer transitory.

#THE BALANCE GOLDILOCKS ECONOMY TV#

I get it.įrank Curzio: Then we rebound a little bit the next trading day, and what do we have? We have Powell go on TV and do a complete 180. Worried about more lockdowns, and less international growth and stuff like that. People are worried, and they should be at the beginning, right? Holy cow, it’s spreading in different countries. DOW’s down 400 points as Omicron surfaced.

And we could look at the past few trading days alone, which have been nuts. I need you to pay attention, because we are heading into 2022, where we will see a very difficult and volatile market. But, today’s podcast is going to be a little serious. I like to have fun with these podcasts and make them entertaining as hell, while educating you on the way and giving you lots of ideas to make money on. I’m Frank Curzio, host of the Wall Street Unplugged podcast, where I break down the headlines, and tell you what’s really moving these markets. Wall Street Unplugged | 828 The 'Goldilocks' economy is officially overĪnnouncer: Wall Street Unplugged looks beyond the regular headlines heard on mainstream financial media, to bring you unscripted interviews and breaking commentary direct from Wall Street right to you on main street.įrank Curzio: How’s it going out there? It’s December 7th. Speaking of gold… Do investors have to choose between gold or cryptocurrencies? Īfter a terrible quarter, a listener wants to know if I think DocuSign (DOCU) is a buy… along with my take on gold stocks. Curzio Research Advisory members will learn all about an exciting new trend-and my favorite way to play it-in tomorrow’s issue. In addition to hedging, you want to own quality stocks… especially those in massive growth trends. Her recommended hedges can save a portfolio during a downturn. And one of the best ways to do that is with our Moneyflow Trader newsletter, edited by Genia Turanova. My advice is to be careful and look to protect yourself. I share some sectors and stocks that will continue to do well as we learn to live with the coronavirus and its variants. Next, I explain why the Fed’s money-printing tactics were successful during the 2008-2009 financial crisis… and why that playbook won’t work this time. and why you should expect more volatility going forward. I highlight many stocks well off their highs…. We’re already seeing volatility around the expectation of rising interest rates.

We’re in unprecedented times… and the only choice the Fed has to fight inflation is going to result in a bumpy ride for stocks. The bottom line is that the “Goldilocks” conditions for a bull market-record low interest rates and trillions in government stimulus-are over.

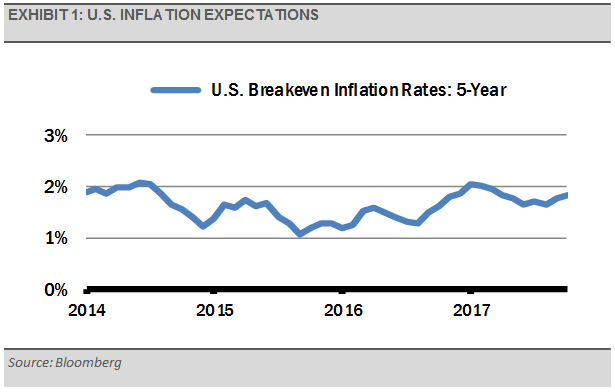

In just the past week, we’ve seen wild swings in the markets over Omicron concerns, surging inflation, and Federal Reserve Chair Jerome Powell changing his tune on whether inflation is transitory. I have a serious message in today’s podcast: Prepare for a tough 2022 in the stock market.

0 kommentar(er)

0 kommentar(er)